The Quick Reference Guide to Pet Insurance

Paris DeesingShare

In a world where our pets are cherished members of the family, their health and well-being become top priorities. However, unexpected illnesses or accidents can lead to hefty veterinary bills that many pet owners are not prepared for. This is where pet insurance comes into play. But what exactly is pet insurance, and why should you consider investing in it? In this article, we’ll explore the essentials of pet insurance, including its benefits, types, and tips for choosing the right plan for your furry friend.

What is Pet Insurance?

Pet insurance is a policy that helps cover the costs of veterinary care for your pets. Much like health insurance for humans, it offers financial protection against high medical expenses related to illnesses, injuries, and sometimes routine care. By paying a monthly premium, you can avoid significant out-of-pocket costs when your pet requires medical attention. You can budget for your premium and avoid making important pet health decisions based on cost alone.

Why Pet Insurance Matters

1. Financial Protection

One of the main reasons to invest in pet insurance is financial security. Veterinary care can be expensive, with emergency treatments, surgeries, and medications quickly adding up. Pet insurance helps mitigate these costs by reimbursing you for a portion of your veterinary expenses, depending on your plan. At Royal Pet Box, one of our dogs, Beige Malone, needed knee surgery that was over $4000. Later, the second knee required the same surgery. While we were sad our girl had to experience two surgeries, we were so happy we had pet insurance that covered 90% of the costs. And now, years later, she is still able to keep up with Mickey, our younger Mini Poodle.

2. Peace of Mind

Knowing that you have a safety net for your pet’s medical needs provides peace of mind. You can focus on your pet’s health without constantly worrying about how you will cover the bills.

3. Access to the Best Care

With most pet insurance policies, you’re not limited to certain veterinarians or treatment options based on cost. Instead, you can choose the best care for your pet without financial constraints.

4. Early Detection of Health Issues

Some pet insurance policies offer wellness plans that cover routine care like vaccinations and check-ups. Regular visits can help detect health issues early, potentially preventing more serious and costly problems down the line.

Types of Pet Insurance Plans

Understanding the different types of pet insurance plans can help you select the one that best suits your needs and budget. Here are the main types of coverage available:

1. Accident-Only Coverage

What It Covers: Injuries resulting from accidents, such as broken bones, cuts, or poisonings.

Ideal For: Pet owners who want a basic plan to cover emergency situations without paying for illness coverage.

2. Accident and Illness Coverage

What It Covers: Both accidents and illnesses, including chronic conditions like diabetes or arthritis.

Ideal For: Pet owners seeking comprehensive coverage that includes both unexpected injuries and health issues.

3. Wellness Plans

What It Covers: Routine care such as vaccinations, annual exams, and flea prevention.

Ideal For: Pet owners who want to manage the costs of regular check-ups and preventive care.

4. Comprehensive Plans

What It Covers: Accident and illness coverage, plus wellness care and additional services like dental care and behavioral therapy.

Ideal For: Pet owners who want the most extensive coverage and are willing to invest in a higher premium for broader protection.

How to Choose the Right Pet Insurance Plan

Choosing the right pet insurance involves considering several factors to ensure you get the best coverage for your pet’s needs. Here are some tips to guide you:

1. Assess Your Pet’s Health Needs

Consider your pet’s current health condition, age, and breed. Some breeds are predisposed to specific health issues, so you may need more comprehensive coverage.

2. Compare Different Providers

Not all pet insurance plans are created equal. Compare policies from various providers to find the best coverage options and premiums. Look at factors like reimbursement percentages, coverage limits, and deductibles. At Royal Pet Box, we aren't sponsored by any brand of pet insurance. However, we personally have our pets insured with Healthy Paws insurance but there are many other companies to choose from.

3. Read the Fine Print

Carefully review the policy details, including exclusions, waiting periods, and coverage limits. Make sure you understand what is and isn’t covered and what the yearly deductible might be before your policy kicks in. Make sure you understand how the policy cost may increase as your pet ages.

4. Check Reviews and Ratings

Look for reviews from other pet owners and check ratings from independent review sites. This can give you insights into the provider’s customer service and claims process.

5. Consider Your Budget

Choose a plan that fits within your budget while still providing adequate coverage. Remember that higher monthly premiums often come with better coverage and lower out-of-pocket costs when you file a claim.

Top Pet Insurance Providers in 2024

Here are some of the top pet insurance providers* you might consider:

| Provider | Best For | Key Features |

|---|---|---|

| Trupanion | Comprehensive Coverage | No payout limits, direct vet payment option |

| Healthy Paws | Comprehensive Coverage with High Reimbursement | Unlimited lifetime benefits, easy claims process |

| Embrace | Customizable Plans | Wellness add-ons, flexible deductible options |

| Pets Best | Affordable Plans with Wellness Options | Multiple plan options, coverage for alternative therapies |

| Lemonade | Affordable Plans and Easy Claims | User-friendly app, low premiums, quick claim processing |

| Pumpkin | Covers some dental illnesses, exam fees, and alternative therapies | Quick and easy online claims process |

| *Not a complete list, information subject to change. |

Frequently Asked Questions

Q1: What does pet insurance typically not cover?

Pet insurance often excludes pre-existing conditions, certain breed-specific issues, and routine maintenance like grooming, anal gland extractions, dentistry, and more. Make sure to review your policy for specifics.

Q2: When should I get pet insurance for my pet?

It’s best to get pet insurance while your pet is young and healthy. However, some providers offer coverage for pets of all ages.

Q3: Can I use any veterinarian with pet insurance?

Most pet insurance plans allow you to choose any licensed veterinarian, but some may have preferred providers.

Conclusion

Pet insurance is a valuable tool for managing the costs of veterinary care and ensuring that your furry friend receives the best possible treatment. By understanding the types of coverage available, evaluating different providers, and considering your pet’s specific needs, you can make an informed decision and choose the best plan for your situation.

Investing in pet insurance not only provides some financial protection but also offers peace of mind, knowing that you can focus on your pet’s health without the stress of unexpected expenses. Take the time to research and compare options to find a policy that offers the coverage you need at a price you can afford.

References

- American Veterinary Medical Association (AVMA) – Pet Insurance

- Pet Insurance Review – Comparison and Ratings

- Consumer Reports – Pet Insurance Buying Guide

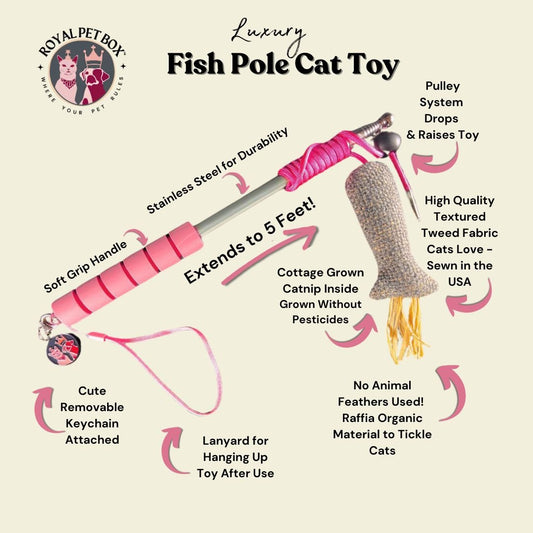

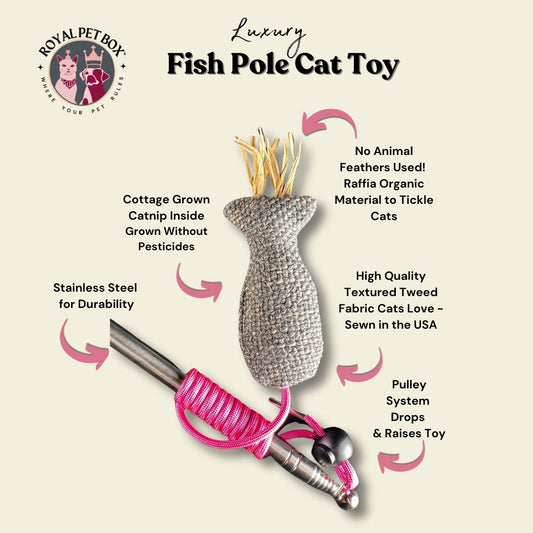

Check out our luxury pet products at reasonable prices, shown below. Visit our "Royal Pet Box Pet TV" Channel on both Roku and YouTube for fabulous pet-related education and entertainment.